maryland digital advertising tax sourcing

732 imposes a tax of up to 10 on gross revenue from digital advertising services placed by large digital advertisers such as Facebook Inc. Digital Advertising Services Tax Sourcing.

Vital Signs Digital Health Law Update Winter 2022 Jones Day

However this tax is limited to advertisements that use personal information about the people the ads are being served to.

. Maryland digital advertising tax sourcing Monday February 28 2022 Edit Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100 million and with digital ad revenue sourced to Maryland of 1 million or more. Earlier today the Maryland State Senate completed the General Assemblys override of the Governors veto making the Maryland digital advertising tax the first of its kind in the United States. Maryland digital advertising tax sourcing Sunday May 15 2022 Edit.

This is a completely new tax with its own tax return. Digital Advertising Gross Revenues Tax ulletin TTY. While the Maryland Tax is imposed on digital advertising services in the state the Act does not include sourcing rules or methodologies and leaves it to the Comptroller to adopt regulations that determine the state from which revenues from digital advertising services are derived.

The DAT is currently scheduled to take effect on January 1 2022 and. Per the Maryland Administrative Procedure Act the final adopted regulations will go into effect in 10 calendar days or December 13 2021See. This new law imposes a tax on annual.

2 The regulations provide a set of rules for sourcing digital. 732 on February 12 2021 making Maryland the first state in the country to adopt a tax on. On August 31 2021 the Maryland Comptroller filed proposed regulations on the controversial digital advertising gross revenues tax the DAT with the Joint Committee on Administrative Executive and Legislative Review.

The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on October 8 2021. In March 2020 Maryland lawmakers adopted legislation creating a first-in-the-nation tax on digital advertising served into the state.

2 days agoIn Marylands case the tax at issue is a four-tiered gross receipts tax on all revenue earned from digital advertising in the state even though traditional advertising revenue is. The introduced version of Senate Bill 2 proposed to source and tax digital advertising services to Maryland based on either. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021.

New Yorks bills A10706 and S08056-A followed the same general structure as Maryland with a 25 - 10 digital advertising gross revenues tax. Its a gross receipts tax that applies to companies with global annual gross revenues of. Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410-260-7980 Baltimore area or 1-800-638-2937 elsewhere in Maryland E-mail.

First is the lack of clear sourcing rules. Its modeled after the digital services taxes weve seen adopted in other countries. 1 Of primary interest to potential DAT taxpayers and described in this Legal Alert the regulations adopt a device-based.

New York Digital Advertising Gross Revenues Tax. 1 This tax which is intended to be imposed on the annual gross receipts derived from certain digital advertising services provided in Maryland became effective on Jan. House Bill 732 adds a new tax imposed in a new Title 75 to the Tax General Article of the Maryland Code.

03120102B Proposed Regulation outlining how the states new tax on gross revenues from digital advertising services DAT will operate. The tax is imposed on entities with global annual gross revenues of at least 100 million that have annual gross revenues derived from digital advertising services in Maryland of at least 1 million in a calendar year. The new law HB.

On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation proposed Md.

The Memory Of The World In The Digital Age Digitization And Preservation An International Conference On Permanent Access To Digital Documentary Heritage

422 Startup Failure Post Mortems

Why Doing Business Responsibly Is A Major Brand Differentiator Blog Philips

It Conferences In North America Gartner

Tm2120236 11 S1a Block 37 6877709s

Telcos Urge Govt To Continue Tech Neutral Approach To 5g Economies Of Scale Reap The Benefits Intervention

Hugo Boss Group Managing Board

The Growth Marketer S Playbook By Jim Huffman Ebook Scribd

Factor Analysis Using R Analisis Fundamental Pengusaha Bisnis

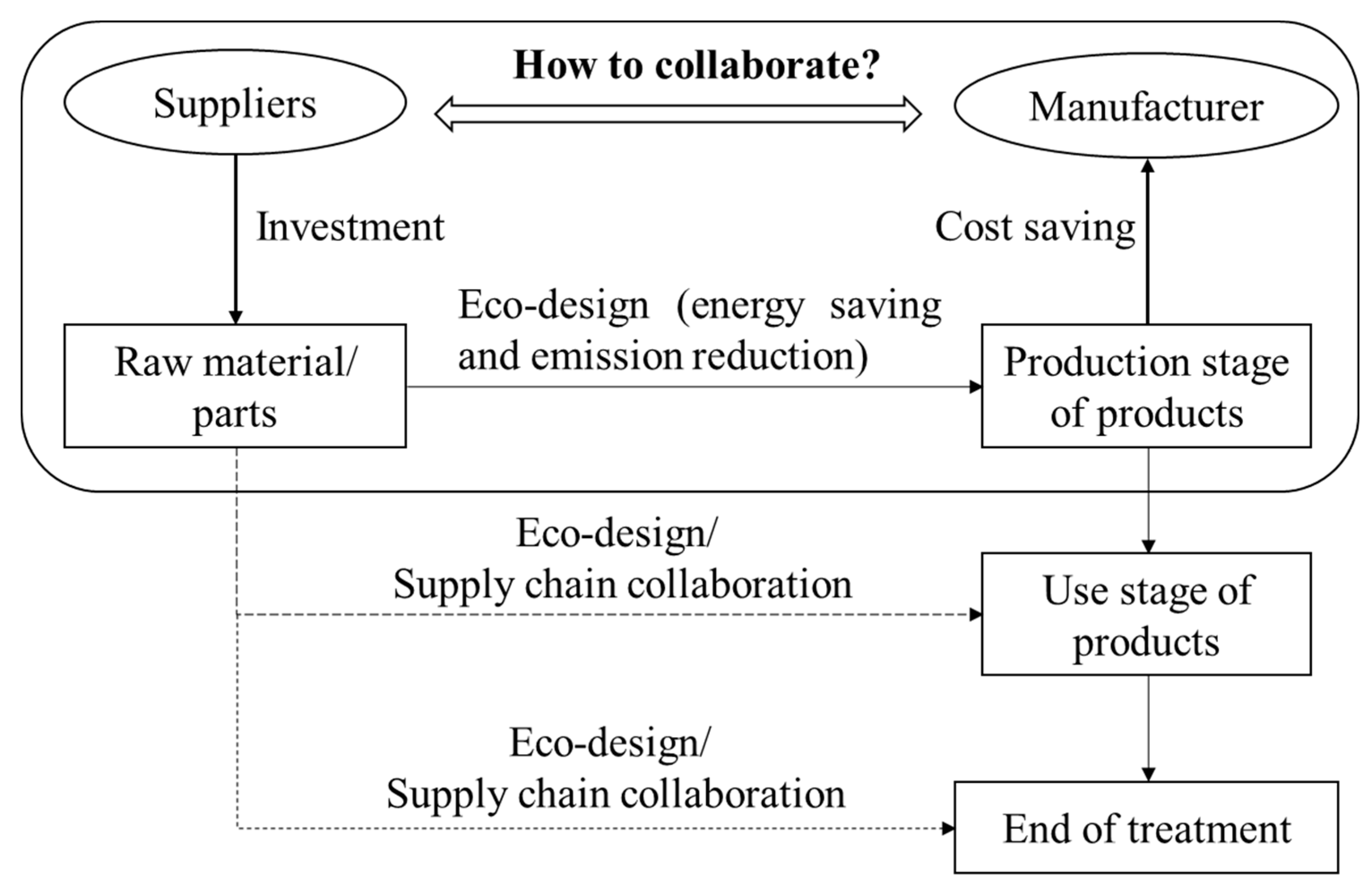

Ijerph Free Full Text The Effect Of A Supplier Rsquo S Eco Design On The Economic Benefits Of A Supply Chain And Associated Coordination Html

Chinaplas 2023 Chinaplas Twitter

Chinaplas 2023 Chinaplas Twitter

Flexibility Agiliity Post Covid 19 Kpmg Global

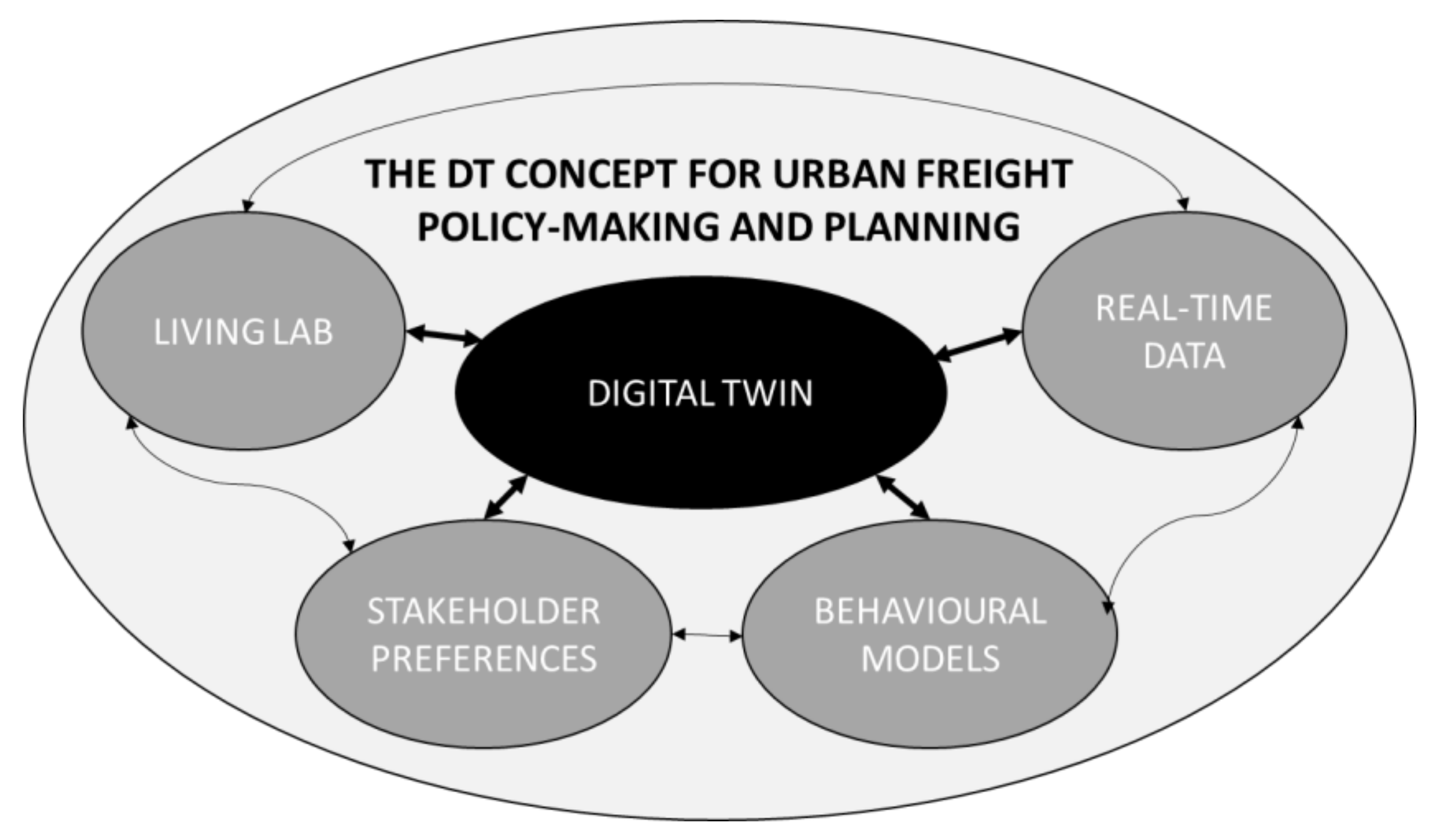

Sustainability Free Full Text Digital Twins A Critical Discussion On Their Potential For Supporting Policy Making And Planning In Urban Logistics Html

Security Alert Five Lessons From The Energy Crisis Wood Mackenzie